Your First Line of Defense Against Fraud

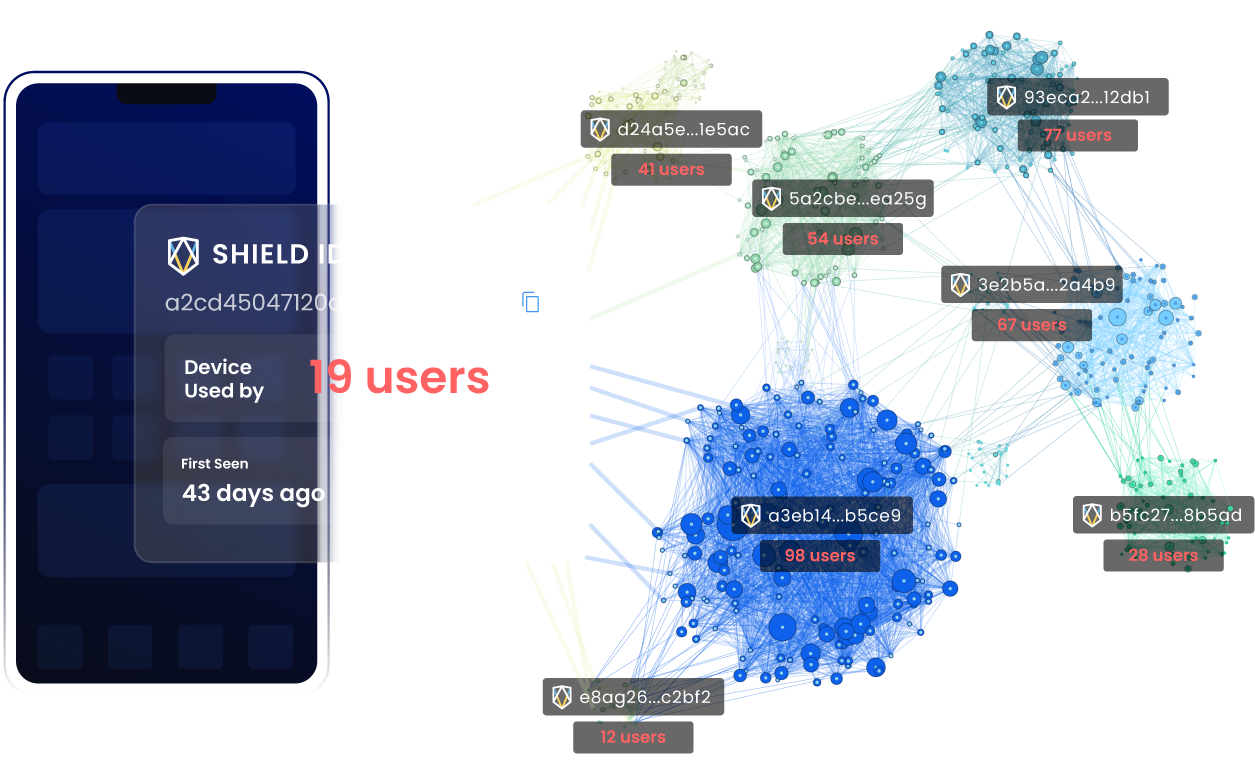

The Device-First Risk AI Platform that Stops Fraud at Its Root

Trusted By

Trusted by

Instant insights. No additional codes needed. Gain intelligence without giving PII data.

Self-configurable risk thresholds. We return all data, and more. Get the full picture with transparent intelligence.

Stay ahead of new and emerging fraud attacks. Real-time attack pattern syncing worldwide.